Are Employee Paid Health Insurance Premiums Subject To Fica

You see the health-insurance premiums paid to cover your rank-and-file workers are generally tax-free to those employees and are tax-deductible by the S corporation as benefits for those employees. If an employer reimburses you for health insurance premiums and the funds are placed in an HSA account the reimbursement is considered a contribution made by you and is subject to income Social.

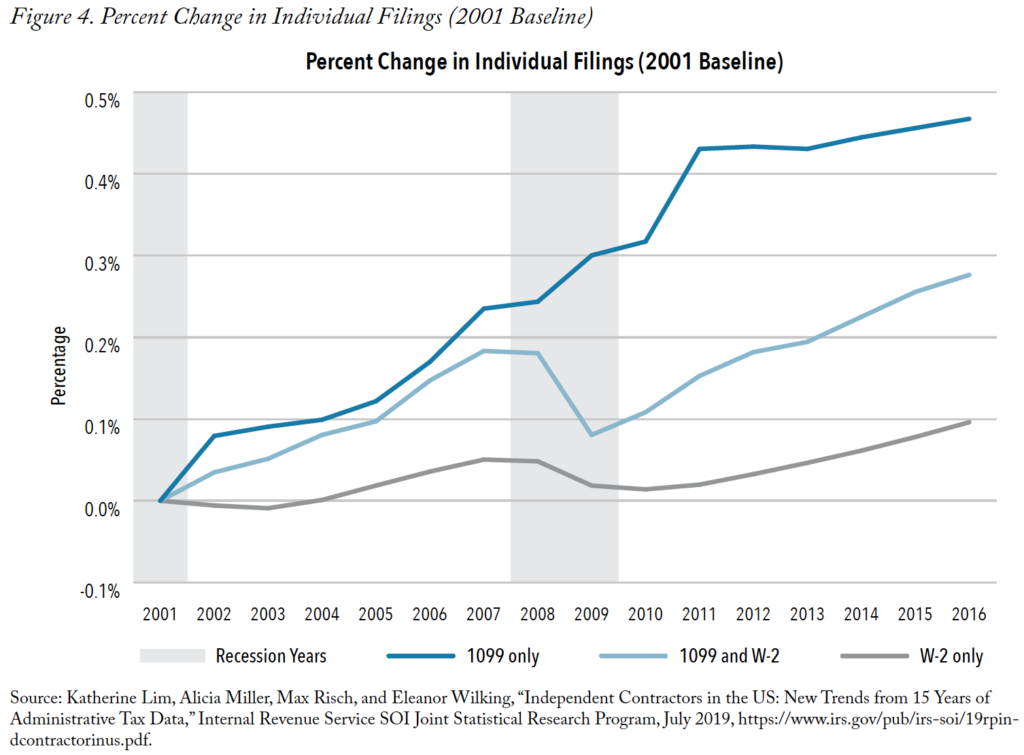

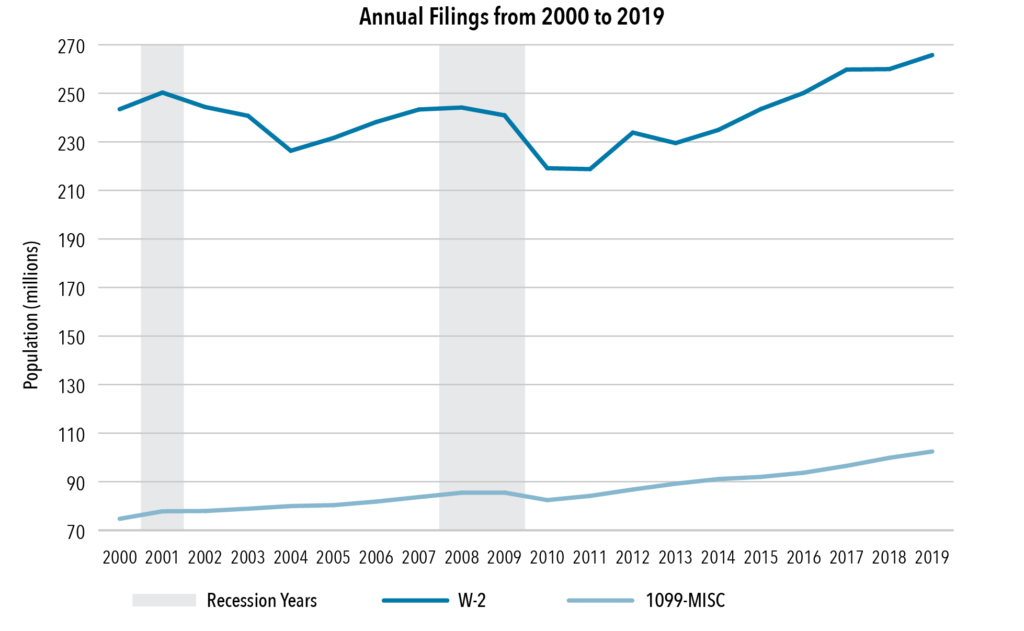

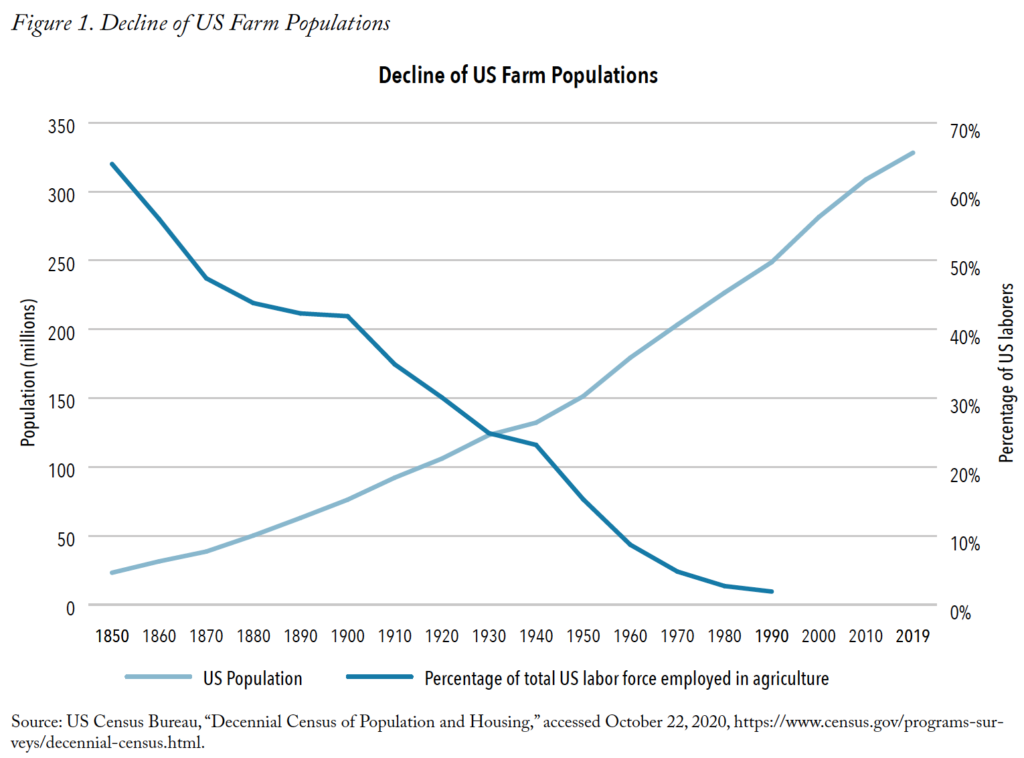

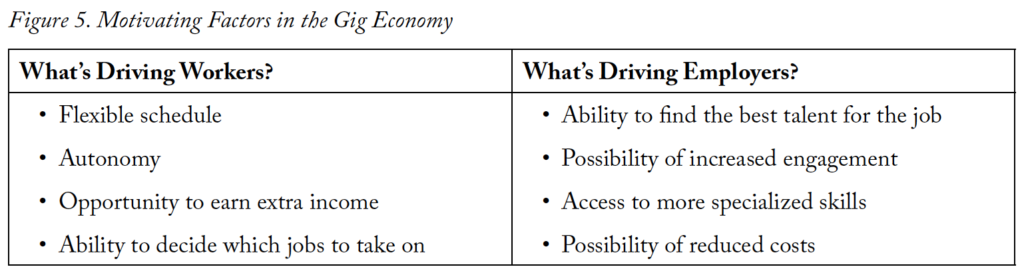

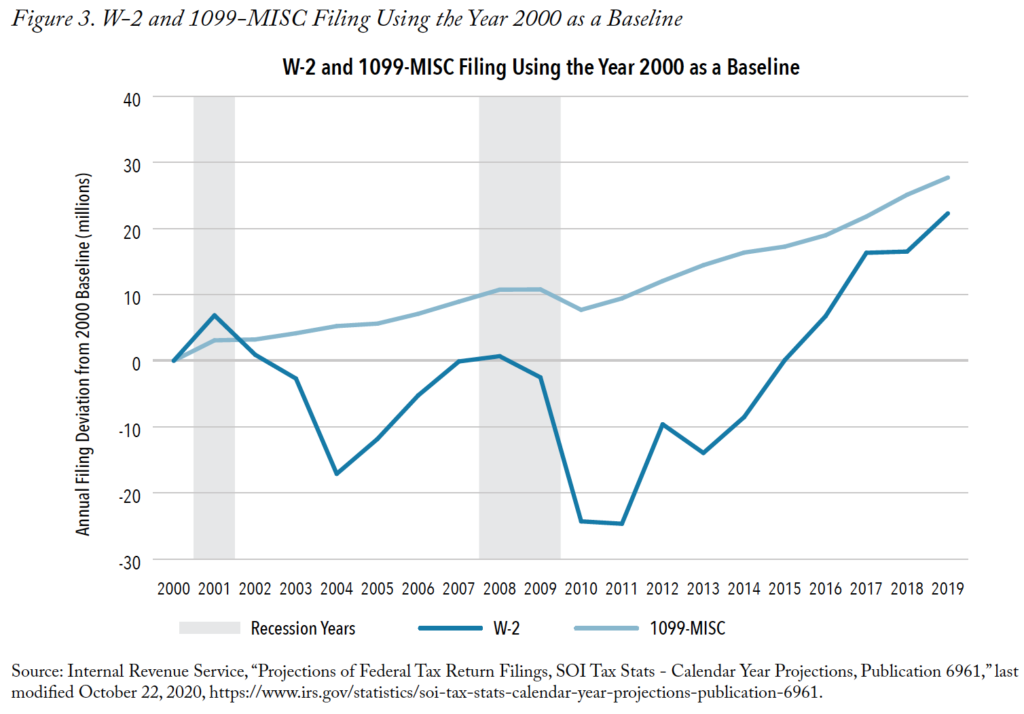

Tech Enabled Gig Jobs Policy Solutions For The Future Of Work The Cgo

You can deduct your health insurance premiumsand other healthcare costsif your expenses exceed 75 of your adjusted gross income AGI.

Are employee paid health insurance premiums subject to fica. This can be seen for example on the W2- boxes 3 and 5 will include pretax health insurance premiums. Employees may therefore be subject to FICA and FUTA taxes. For example employers do not withhold federal income tax from employees pretax 401 k contributions but Social Security and Medicare withholding apply.

Since health insurance premiums are not included in Medicare wages this definition of earned income effectively requires a 2 shareholder have cash wages subject to FICA taxes that equal or exceed the premiums in order for the 2 shareholder to receive the full health insurance deduction on his or her individual return. But life insurance costs paid by your company of over 50000 are taxable to employees. Premiums for adoption assistance and group-term life insurance on coverage over 50000 are not subject to federal income tax but FICA.

Youll get the whole story when you read the full article. Self-employment tax on health insurance premiums for Mr. Form W-2 subject to income tax withholding.

Health and accident insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employees. In contrast if you make a contribution on your own your W-2 will. This cost is included in Box 1 and in Box 12 of the W-2 as one of the options.

Any medical premiums you pay with pretax dollars arent counted in your taxable income. Now if the employer establishes a premium-only plan and says to you I. You cant exclude contributions to the cost of long-term care insurance from an employees wages subject to federal income tax withholding if the coverage is provided through a flexible spending or similar arrangement.

To be clear - pretax medical insurance premiums are subject to FICA. For example if you contribute 1000 through payroll deductions you wont have FICA taxes withheld on that 1000 and your W-2 will show 1000 less income. Smith a self-employed individual.

Educational assistance benefits under 5250 paid to employees in a calendar year are not taxable to the employee if there are provided as part of a qualified educational. Since the premiums paid for health insurance are not considered compensation to the employee or employee owner they are not subject to FICA Social Security and Medicare for either the employee or the employer. If your employer gave you the full 50000 all of it would be subject to payroll taxes including income taxes.

However these additional wages are not subject to Social Security or Medicare FICA or. The benefit amount is subject to all the same income and payroll taxes that apply to. With a section 125 the employer can deduct the premiums from the employers wages before tax and submit those funds directly to the insurance company on behalf of the individual.

You deduct the amount of health insurance premiums paid on Schedule 1 of Form 1040 so you dont pay income tax and FICA taxes on the amount of premiums paid. With this type of set up both the employer and employee will avoid FICA and FUTA taxes on the premiums. If you contribute to your HSA through a payroll deduction the money is excluded from both income taxes and FICA taxes.

These payments are not considered wages and are not subject to employer or employee FICA. This is done through setting up a section 125 payroll redirection. Pretax deductions may lower Federal Insurance Contributions Act FICA taxes federal and state income taxes and employer-paid payroll taxes like.

Your guaranteed payments health insurance included are still subject to self-employment SE tax. When your employer prepares your W-2 your employer wont include these premiums in box 1 your income.

Tech Enabled Gig Jobs Policy Solutions For The Future Of Work The Cgo

How To Put Your New Postdoc Salary In Context Personal Finance For Phds

Vantage Hsa Part Of An Integrated Cdhc Solution A Vantage Health Savings Account Helps You Contain Your Costs Empower Your Employees And Keep Your Benefits Ppt Download

Https Cedarcity Org Documentcenter View 9536

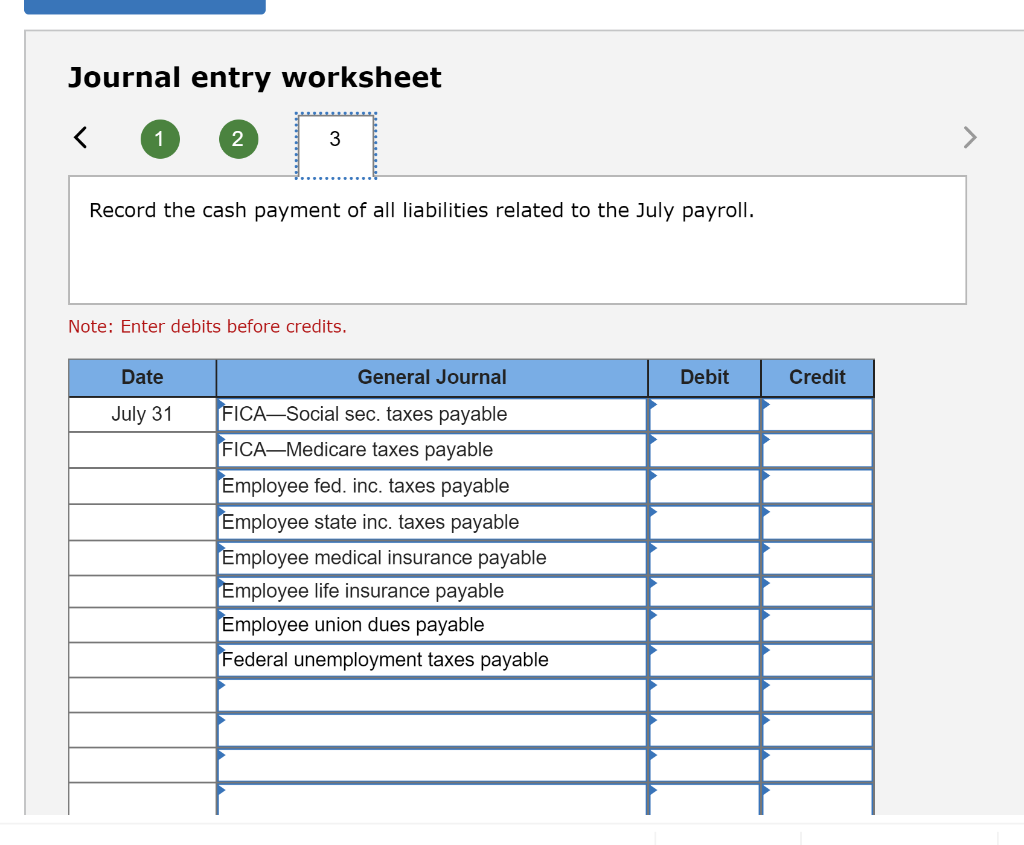

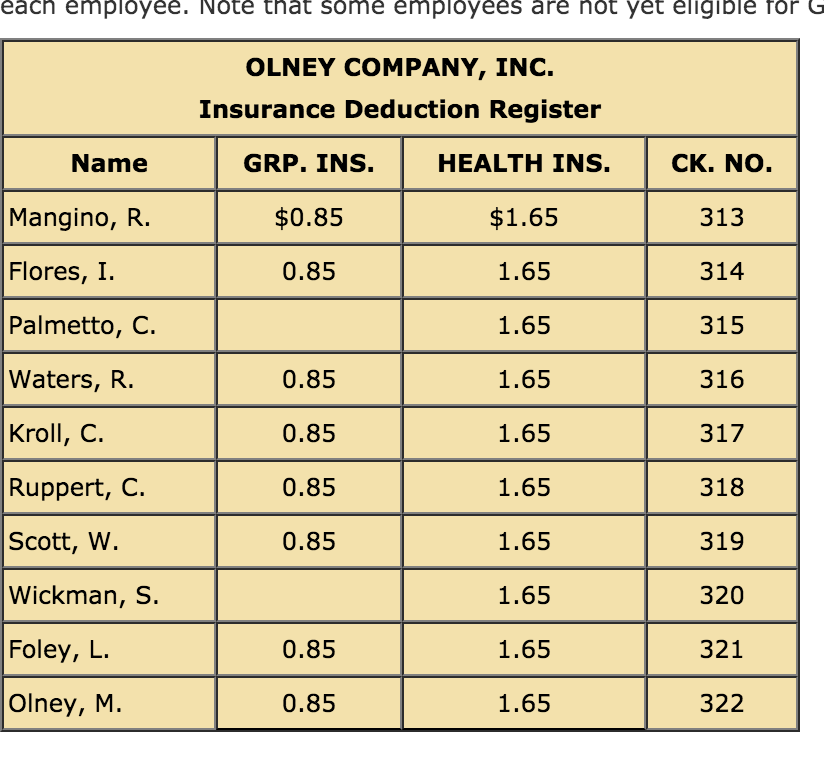

Problem 8 3a Part 3 3 Record The Employer Payroll Chegg Com

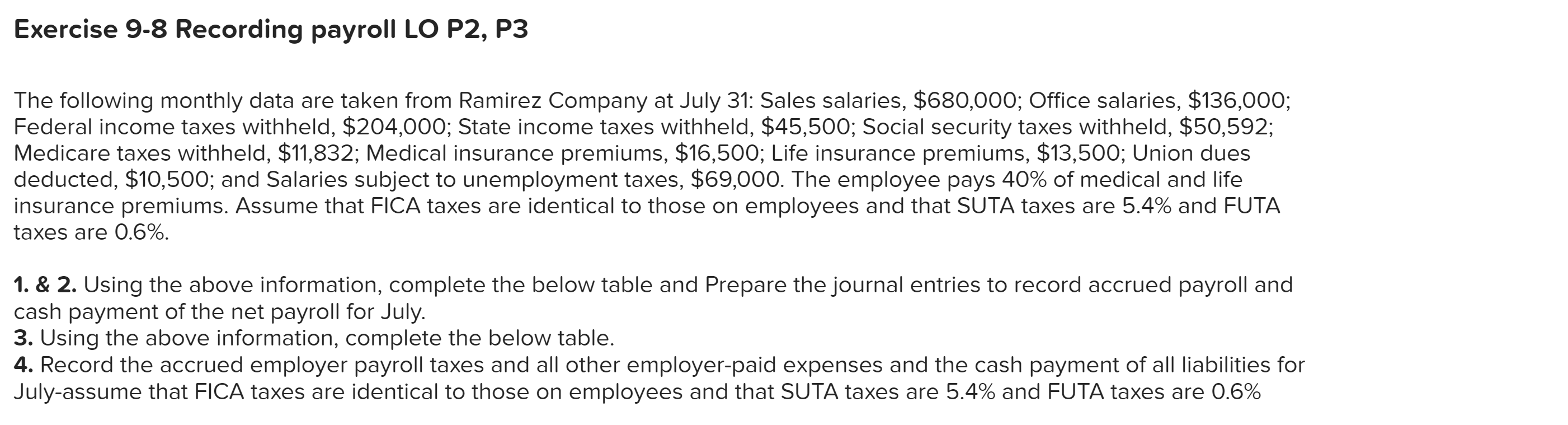

Solved Exercise 9 8 Recording Payroll Lo P2 P3 The Follo Chegg Com

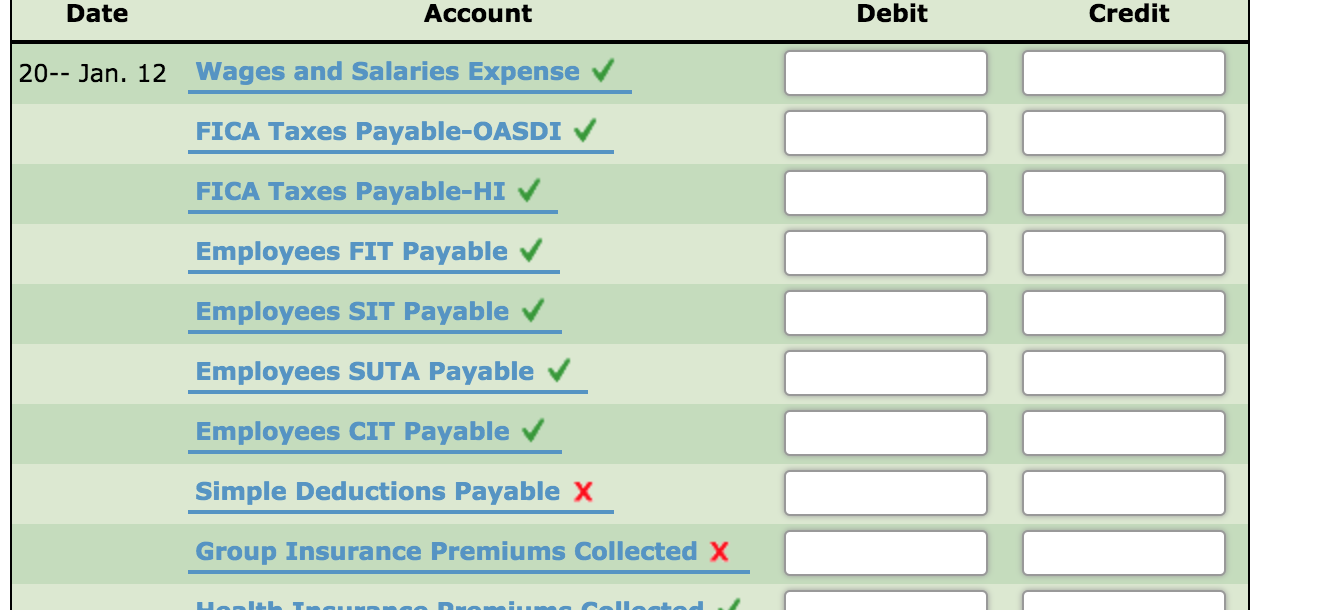

Prepare The Journal Entries As Of January 12 To Chegg Com

Division Of Temporary Disability And Family Leave Insurance Information For Employers

Prepare The Journal Entries As Of January 12 To Chegg Com

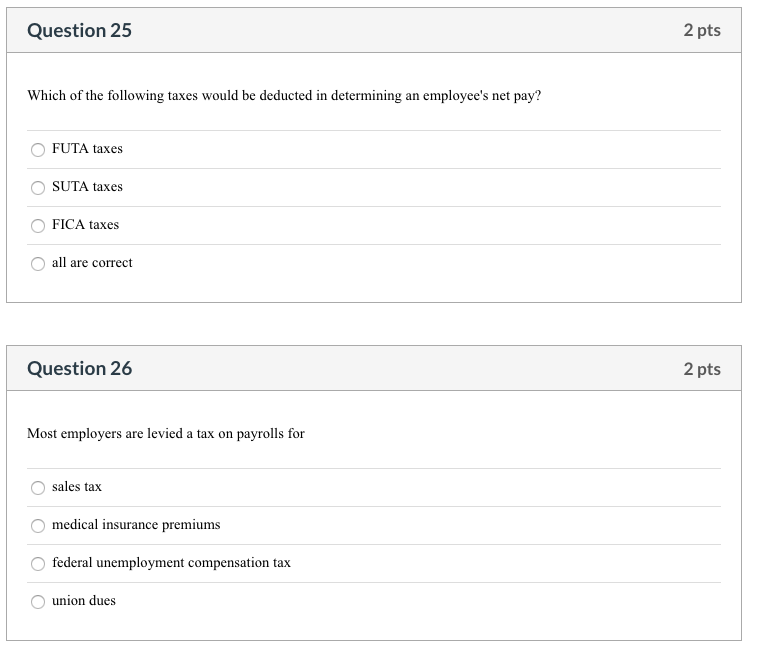

Question 25 2 Pts Which Of The Following Taxes Would Chegg Com

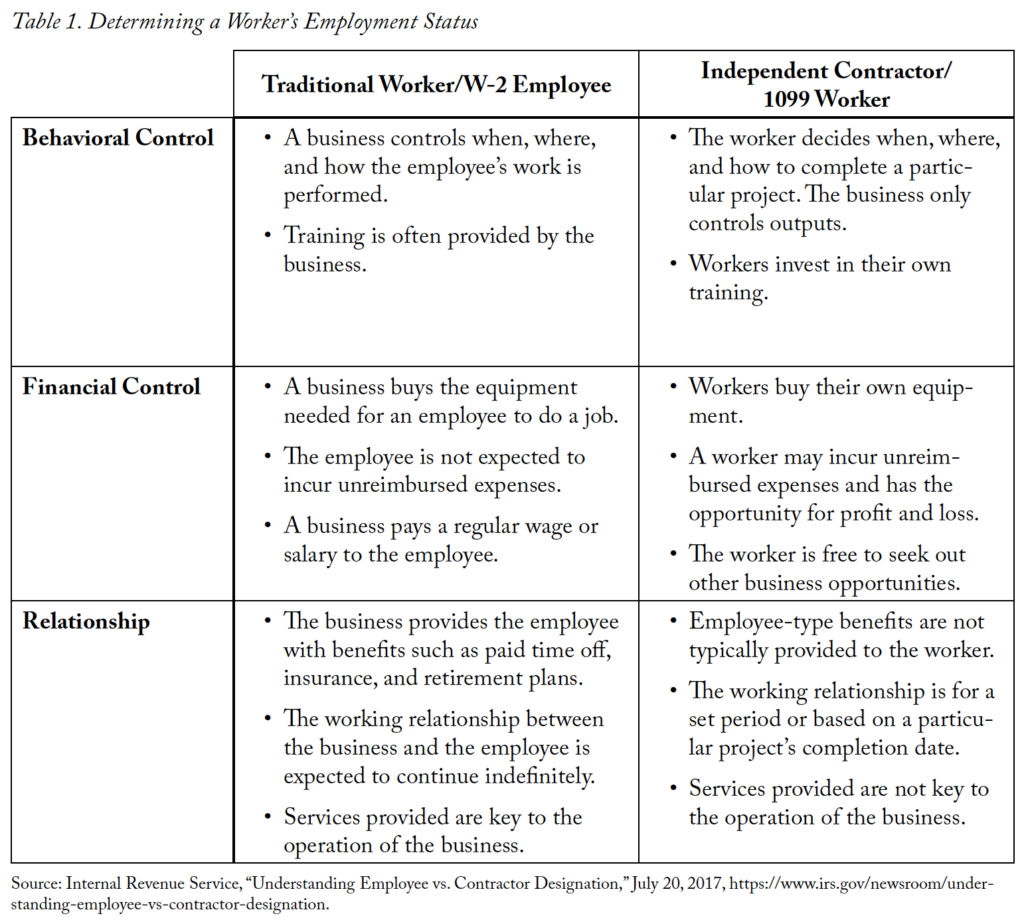

Tech Enabled Gig Jobs Policy Solutions For The Future Of Work The Cgo

Tech Enabled Gig Jobs Policy Solutions For The Future Of Work The Cgo

Solved Exercise 9 8 Recording Payroll Lo P2 P3 The Follo Chegg Com

How To Put Your New Postdoc Salary In Context Personal Finance For Phds

I Am Sorry I Don T Know What You Mean With Time Chegg Com

Tech Enabled Gig Jobs Policy Solutions For The Future Of Work The Cgo

Tech Enabled Gig Jobs Policy Solutions For The Future Of Work The Cgo

Posting Komentar untuk "Are Employee Paid Health Insurance Premiums Subject To Fica"