In Health Insurance Policies A Waiver Of Premium Provision

Most long-term disability policies contain a Waiver of Premium benefit if you become disabled. Under the waiver of premium provision the insurance carrier will waive premium payments for you after you have been totally disabled for at least six months.

Useful Add On Covers With Family Health Insurance Plan

Types of Group Health Insurance Characteristics of Group Health Insurance.

In health insurance policies a waiver of premium provision. What is a Waiver of Premium Rider. After an insured has become totally disabled as defined in the policy After an insured has become totally disabled as defined in the policy. After an insured has become totally disabled as defined in the policy.

Other stipulations may apply such. Notify an insurer of a claim within a specified tim. But never assume this to be the case The waiver of premium rider has a single purpose.

Waiver of premium for disability is a provision in an insurance policy that comes into play if the insurer becomes unexpectedly disabled and cannot pay their policys premium. Such a provision is usually found to be in health life and disability insurance insurance policies. TYPES OF DISABILITY INSURANCE POLICIES Disability Income Policy Income Replacement Business Uses Covers a person who cannot work due to a disabling injury or illness.

Rider or provision included in most life insurance policies and some health insurance policies exempting the insured from paying premiums after the insured has been disabled for a specified period of time usually six months in life policies and 90 days or six months in health policies. The waiver of premium provision keeps the coverage in force without premium payments if the insured has become totally disabled as defined in the policy. In health insurance policies a waiver of premium provision keeps the coverage in force without premium payments.

A waiver of premium is a provision that allows the insured not to pay premiums during a period of disability that has lasted for a particular length of time. Theyre most common on life insurance policies but you can obtain health insurance and critical illness cover with provisions for the waiver of premiums. This provision in the long-run could be the difference between the insurer keeping the policy or losing it.

A waiver of premium is a provision in an insurance policy that ensures the continuation of the policys effectivity in the event that the policyholder can no longer pay the premiums. A waiver of premium for disability provision can be added at an additional cost to the insurance contract. Keep in mind that the waiver of premium provision is not designed to stop premium payments for minor events so read your policy carefully.

Lets see if we can help Susan understand the health insurance claims process. The rider suspends your insurance premium payments in the event you become ill or disabled and cannot work. It covers your life insurance premiums if you become totally disabled.

This rider that is attached typically to a life insurance policy. A waiver of premium rider is an optional provision in a life insurance policy though some policies do offer it as a standard inclusion. This provision if included in your policy states that premiums will be waived when a determination is made by the insurance company that you are totally or partially disabled.

Health insurance is a type of insurance that pays for expenses you incur due to an illness an injury or a medical. The Notice of Claims provision requires a policyowner to. In health insurance policies a waiver of premium provision keeps the coverage in force without premium payments.

Under a provision known as time payment of claims in a health insurance policy after receiving proof of loss all benefits other than those that are paid in periodic installments are supposed to be paid. Waiver of premiums cover your monthly premiums on your insurance if youre out or work either until youre working again or the policy expires while keeping your coverage intact. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill seriously injured or disabled.

The amount the. Waiver Of Premium - Nearly all LTC policies include a waiver-of-premium provision that takes effect after the insured has been confined for a specified period of time typically ninety days but as long as 180 days with some policies. A waiver of premium provision is a rider that can be attached to an existing policy for an additional cost.

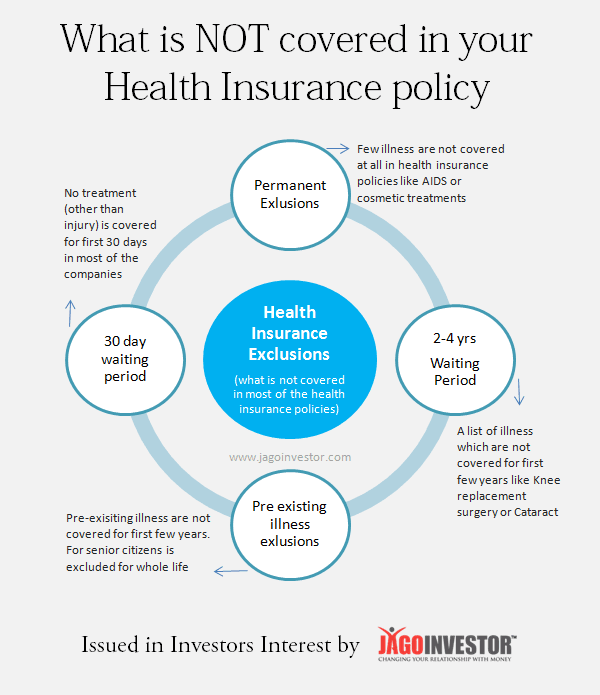

4 Kind Of Exclusions In Your Health Insurance Policy Which Are Not Covered

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

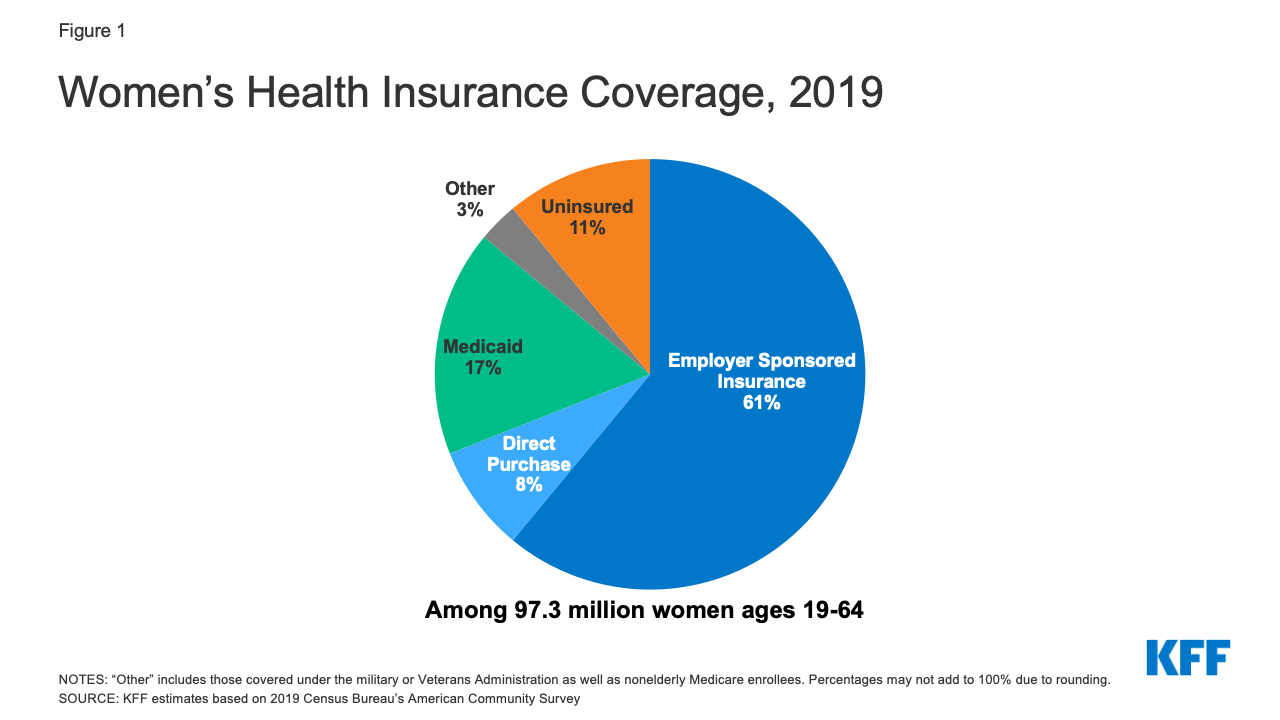

Women S Health Insurance Coverage Kff

The Health Insurance Penalty Ends In 2019

Is Abortion Covered By Health Insurance In India 2021

What Is Waiting Period In Health Insurance A Detailed Guide

Insurance Waiver Template Pdf Templates Jotform

What You Need To Know About Health Insurance Tax Benefits Health Insurance Quote Health Insurance Health Insurance Plans

Pdf Comparative Analysis Of Health Insurance Systems In The United States And South Korea

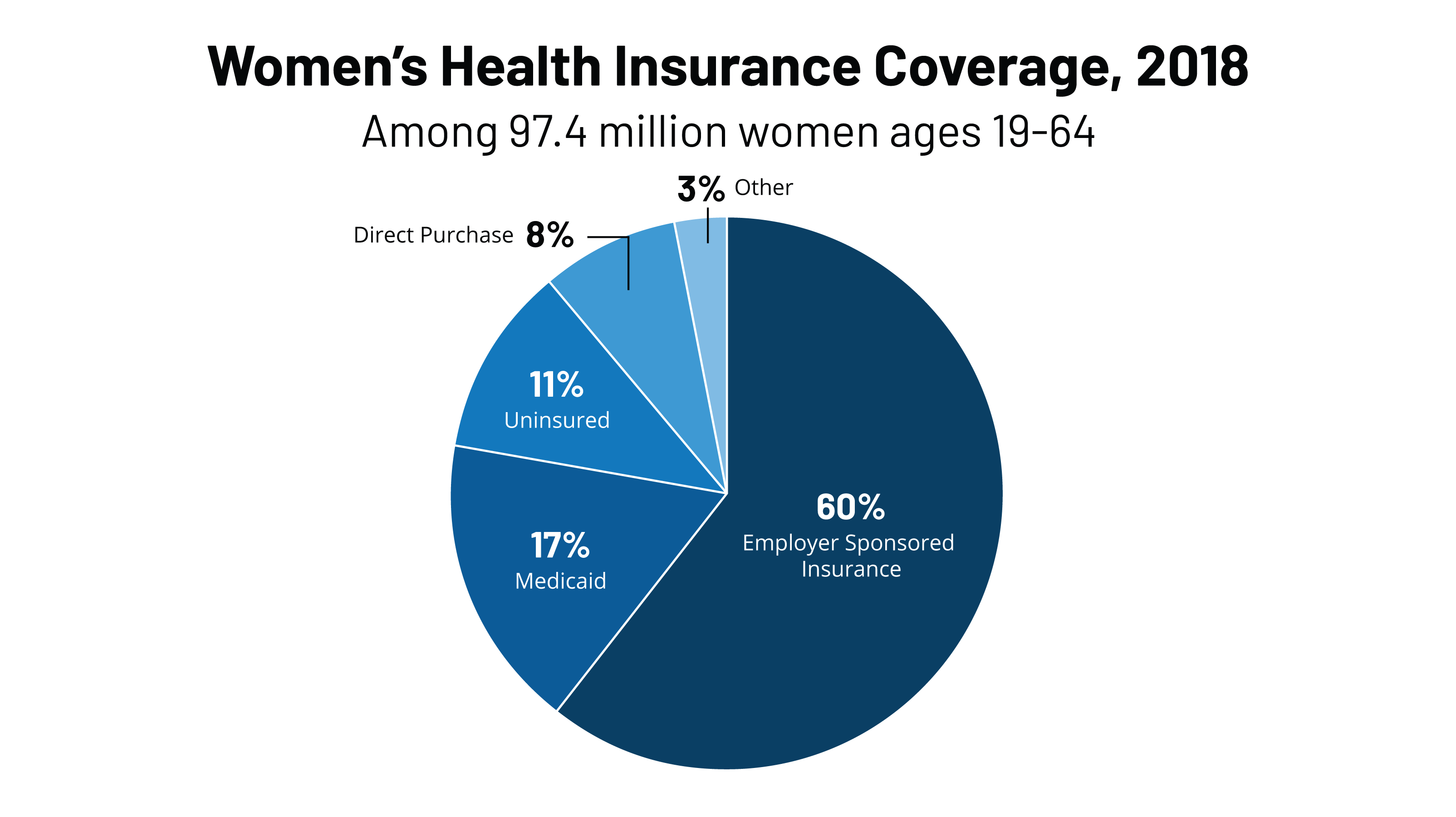

Women S Health Insurance Coverage Kff

What Is Health Insurance Plan Definition Types Benefits Abc Of Money

Pdf Comparative Analysis Of Health Insurance Systems In The United States And South Korea

Star Senior Citizen Red Carpet Plan Online Reviews Policy Benefits

Best Health Insurance Plans In India 2021 Policyx Com

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

What Is An Individual Health Insurance Policy

Posting Komentar untuk "In Health Insurance Policies A Waiver Of Premium Provision"