Average Monthly Cost Of Health Insurance For Retired Couple

Singles pay an average of 567 per month for insurance premiums. There are five types of health care premiums you are likely to have in retirement.

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Spousal Benefits Can Enable Insurance for an Early Retirement.

Average monthly cost of health insurance for retired couple. For families that cost more than doubles to 1152. Medicare Part B Medigap Medicare Part C Medicare Part D and long-term care. The average retiree spends around 4300 per year on out-of-pocket healthcare costs according to a study from the Center for Retirement Research at.

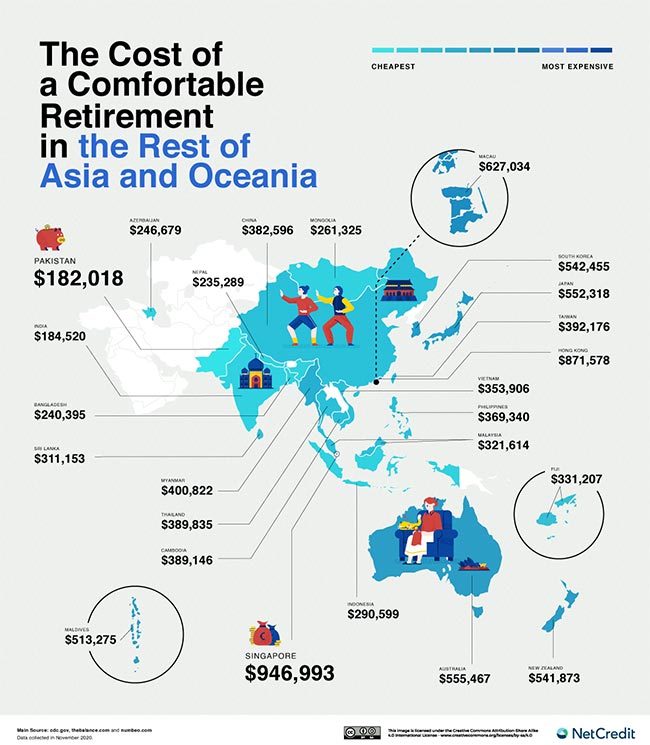

The average health insurance plan costs nearly 5500 per year for an individual and close to 14000 for a family according to a 2020 study by eHealth. Families pay around 57 more. In fact a 65-year-old couple that retired in 2019 can expect to pay 285000 in healthcare and medical expenses during their retirement.

A healthy 65-year-old couple retiring in 2019 will need close to 390000 to cover health-care expenses including Medicare Parts B and D according. In 2020 the average cost of health insurance is 554 per month for a 40-year-old person. Blue Cross Blue Shield provides the best rates in the majority of Florida and has offerings in every county.

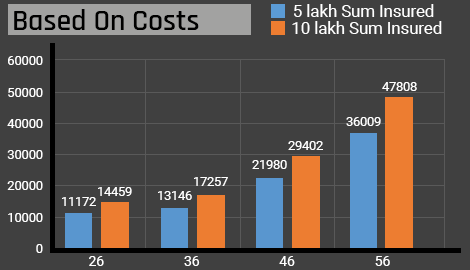

Singles pay around 34 more for a PPO. Medicare may pay for some health care spending in retirement but does not fully cover all of it. The average health insurance premium for a policyholder at 45 is 289 up to 1444 times the base rate and by 50 its up to 357 which comes out to 1786 x 200.

For a male age 65 the calculator estimated total premiums and out-of-pocket costs at about 4500 a year. To get an estimate of marketplace health insurance costs in your area including. There are two reasons for this.

What is the average cost of health insurance on a PPO. But you might qualify for some government subsidies through the Affordable Care Act. Couples should double that number.

You need more health care as you get older and costs are expected to keep climbing. In 2020 the average costs per month for an individual marketplace plan was 456 according to eHealth. Your health care will likely be cheapest during your first year of retirement.

Those totals vary based on factors like. This is a decrease of 4 from 2018 when the monthly rate was 575. On average a couple retiring at 65 can expect to spend 220000 on health care costs during retirement -- and that does not include long-term-care.

The average couple retiring in 2019 at age 65 will need 285000 to cover health care and medical costs in retirement according to an annual estimate by Fidelity released today. For older households expenses total about 3800 a month on average which is only about 1000 less than for younger Americans. The average national monthly health insurance cost for one person on an Affordable Care Act ACA plan in 2019 was 612 before tax subsidies and 143 after tax subsidies are applied.

How Much Is Health Insurance per Month for One Person. It will cost a lot since you will no longer have an employer picking up some of your costs. A 65-year-old retired couple in 2020 will need 295000 for medical expenses in retirement.

For single retirees the estimate is 150000 for women and 135000 for men according to Fidelity. Continuation coverage under COBRA is typically available for a relatively short period of time typically 18 to 30 months. The average cost of health insurance for a 40-year-old person is 554 per month.

Families pay an average of 1584 per month for insurance premiums. Because of the effects of inflation a 50-year-old couple in 2019 planning to retire at age 65 can expect to spend about 405000 on health care in retirement. An option that you may have if you are married is to use your spouses health insurance.

Average health insurance cost for a single male. PPO plans often cost a little more. After age 50 premiums rise.

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies.

Trends In Employer Sponsored Health Insurance Health Insurance Healthcare Education Health Care Reform

Pin On Medicare Social Sec Info

Healthcare Planning For Retirement Average Costs And More

Pin On Worth Reading Blogs Articles Books

Life Insurance Fact Vs Fiction Lifeinsurance Family Termlifeinsurance Lifeinsurance Life Insurance Facts Life Insurance Policy Buy Life Insurance Online

Don T Freak Out About Health Care Costs In Retirement

Overcoming The Fear Of Retirement Personal Finance Blogs Retirement Personal Finance

Zihuatanejo Mexico Retirement Lifestyle And Cost Of Living Information Zihuatanejo Zihuatanejo Mexico Mexico

How Much Does It Cost To Retire In Thailand A Complete Guide

Find Out What Life Insurance Do What Is Life About Life Happens How To Protect Yourself

.png?width=550&name=steps%20in%20retirement%20planning%20(2).png)

Retirement Planning Guide To Help You Achieve Your Ideal Retirement

Health Care Costs In Retirement What To Expect How To Plan

How Much Does It Cost To Retire In Thailand A Complete Guide

The Salary You Need To Afford The Average Home In Your State Based On A 30 Year Mortgage With A 10 Map 30 Year Mortgage Us Map

Spend Retirement In Your Way Investing For Retirement Retirement Planning Financial Planning

Pin On Money And Or Retirement Zinfo

Senior Citizen Health Insurance Best Health Plans For Senior Citizens 2021

Posting Komentar untuk "Average Monthly Cost Of Health Insurance For Retired Couple"