Can I Decline My Employer's Health Insurance

What happens if I refuse health insurance by my employer. During this time period an employee can apply for.

Medical Insurance Premium Paid By Employer Abc Of Money

Often an employer subsidizes part or all of their employees coverage.

Can i decline my employer's health insurance. If your employer cancels your health insurance it will trigger a special event enrollment window. If your OHI denies a claim for any reason including a lack of referrals Tricare will generally also deny the claim. Some employers offer extra pay to employees who decline to enroll in employer-offered group health coverage.

The penalty for employer or employee is triggered when the employee goes to the exchange and receives a tax credit. However you should be aware of the rules and consequences before opting out. If an employer is going to cancel health insurance they must provide employees with a 30-day notice.

You can decline employer health insurance its called a waiver of coverage but you wont be able to get cost assistance through ObamaCare or dependent coverage through the employer plan if coverage was offered. You can decline your employer health insurance during open enrollment. You can decline or waive this benefit.

They can only enroll in coverage outside of their eligibility window during a companys open enrollment period or in the event of a qualifying life event. However these opt-out payments may have consequences for employers because they may. Its super important to follow the rules of your OHI.

If there are going to be material benefit changes the employer must provide a 60-day notice. You must offer affordable minimum value health coverage. If you reject individual health insurance through your employer you can sign up for the Obamacare plan through the Marketplace.

Otherwise theyll have to wait for the next enrollment period to come around unless they have a qualifying life event like a. This was true for both small and large groups and employers faced steep fines for noncompliance. You do not have to take it if it is too expensive and you want to find cheaper coverage elsewhere.

But if you decide not to go with your employers plan that benefit will not available. You arent required to accept an employer health insurance plan. So an employer who must comply with the mandate can offer increased compensation but cant treat it has a qualifying arrangement unless they offer a group plan.

But you may have to sign a waiver that you will be obtaining another insurance plan or accepting someone elses insurance coverage so that your employer has proof that you are insured for legal purposes Schrader says. The first step is to submit your claim to your OHI. CoveredCA FAQs say that anyone of any income can.

The pre-tax aspect of employer-sponsored coverage is a particularly important point as people who buy individual market health insurance can only deduct their premiums if theyre self-employed or if their total medical costs including premiums amount to more than 75 percent of their income 10 percent as of 2021 with only the portion above that level being eligible for the tax deduction. Although you are most likely not eligible for any subsidies or other financial assistance. Under IRS guidance related to the implementation of the Affordable Care Act ACA there was a several-year stretch when employers were not allowed to directly reimburse employees for the cost of individual market health insurance.

But if the coverage your employer offers doesnt meet the tests for affordability and minimum value youd be eligible to receive a subsidy to offset the cost of health insurance purchased through the exchange as long as youre a legal US. I was told by customer rep from CoveredCA that I cannot refuse employer coverage if its affordable to me ie annual health premiums 95 of my gross annual income. Employees can only decline employer-sponsored insurance during an open enrollment period which they may be in the middle of if they just started at your company.

Nonetheless you can still claim your insurance costs as a medical expense if you meet the Internal Revenue Services requirements. For example if you or a spouse earns self-employment income you wont be able to claim the self-employed health insurance deduction if you would have been eligible for an employer-sponsored healthcare plan. Once your claim is paid by your OHI it is then forwarded to Tricare.

Resident and you qualify for a subsidy based on household income note that you might still end up being ineligible for a subsidy since the calculation will be based on whether or not the cost of the. Those who choose decline coverage during initial enrollment will not be covered under their employers insurance plans or pay any premium deductions. An employee who declines affordable minimum value employer coverage and applies for subsidized coverage on the exchange will be subject to a penalty.

Lets revisit your responsibilities as a large employer. We answer these questions by outlining three instances which are becoming increasingly common when you may want to consider dropping your employers health insurance as part of your. So you may end up paying more to purchase your own insurance on the exchange rather than accepting the insurance your employer offers.

It is your choice. Under the Affordable Care Act employers cant reimburse an employee for non-group health insurance and treat it as offering benefits and complying with the mandate.

![]()

When Is An Ok Time For An Employee To Drop Their Medical Insurance Can An Employer Force An Employee To Keep Their Health Insurance Workest

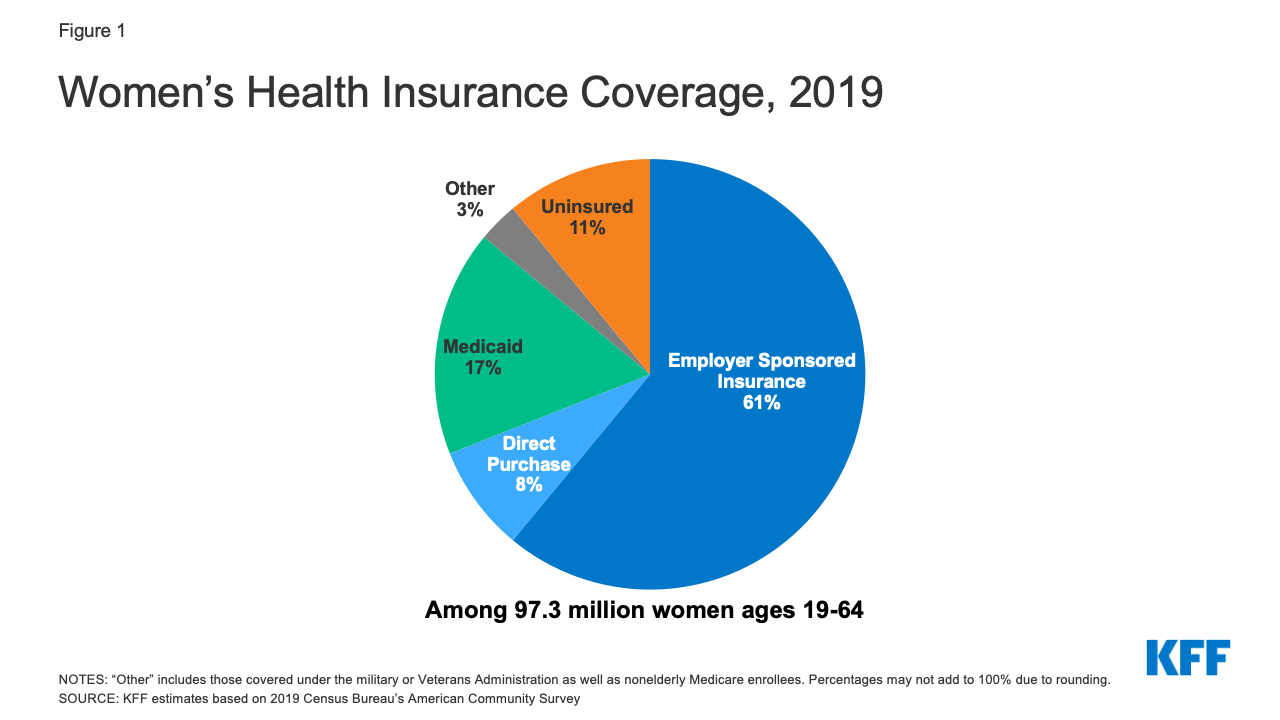

Women S Health Insurance Coverage Kff

Why Was My Application For Healthinsurance Declined Isn T That Illegal Aca Health Insurance Application Investigations

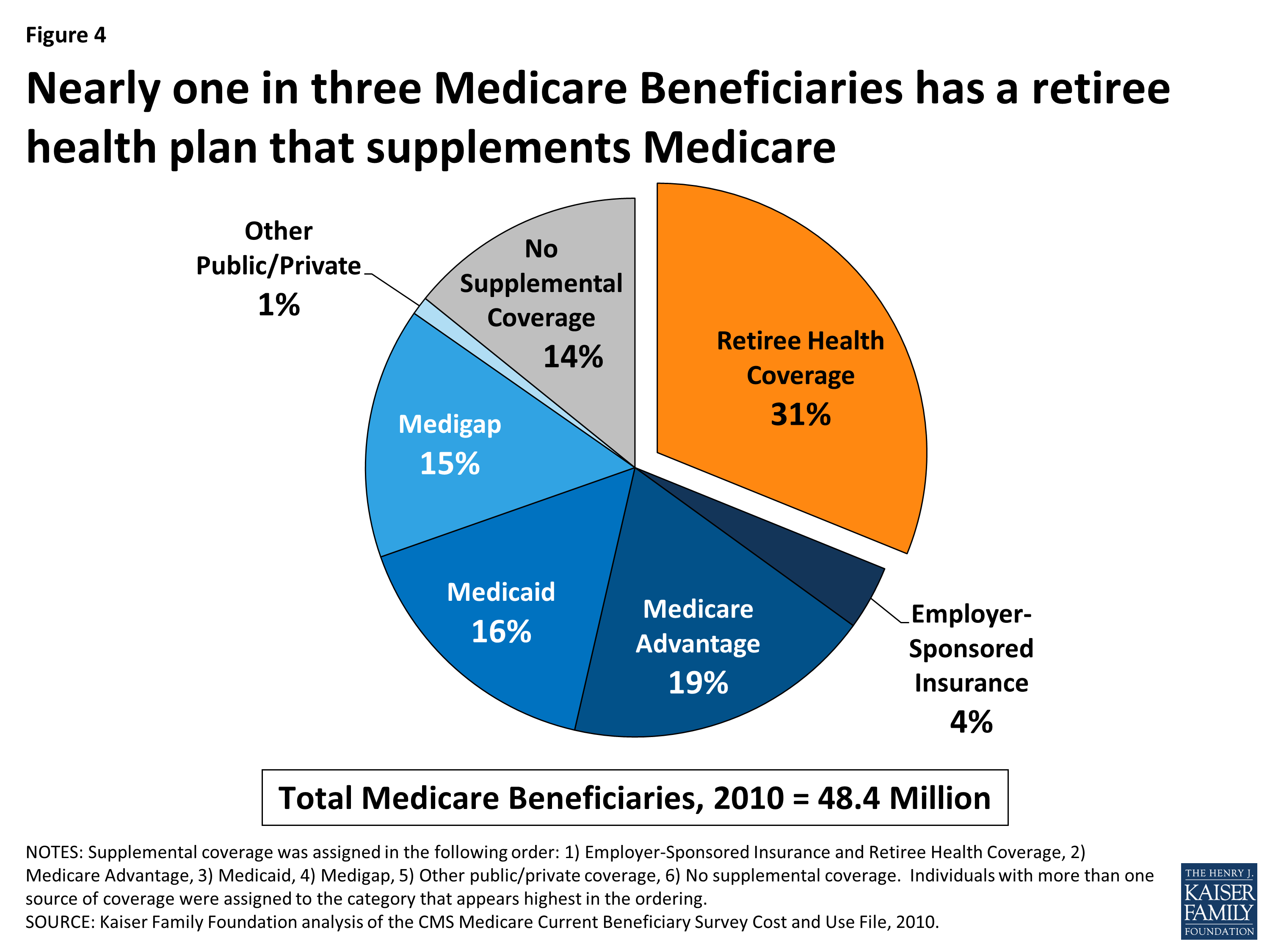

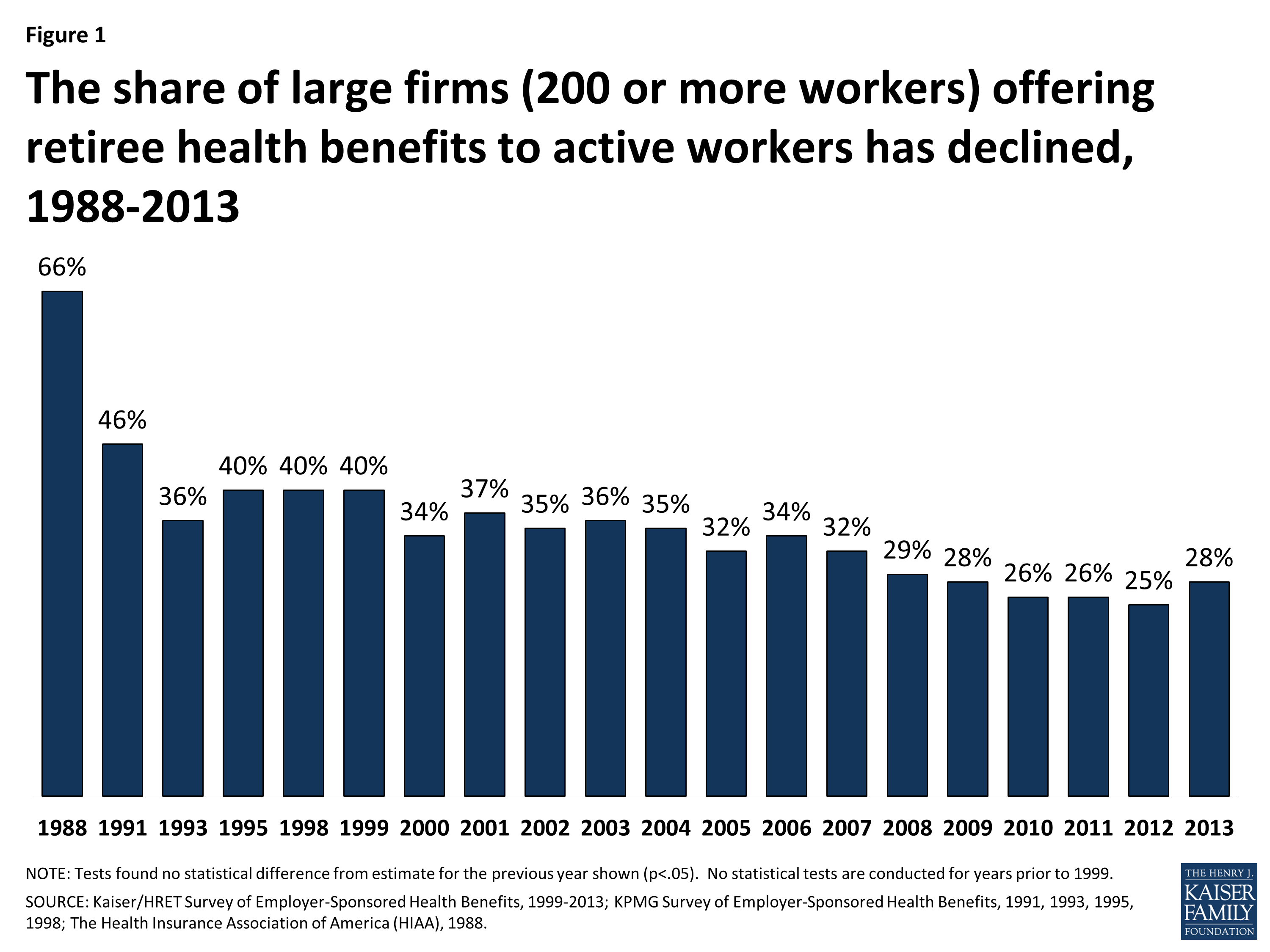

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Different Types Of Health Insurance Plans

![]()

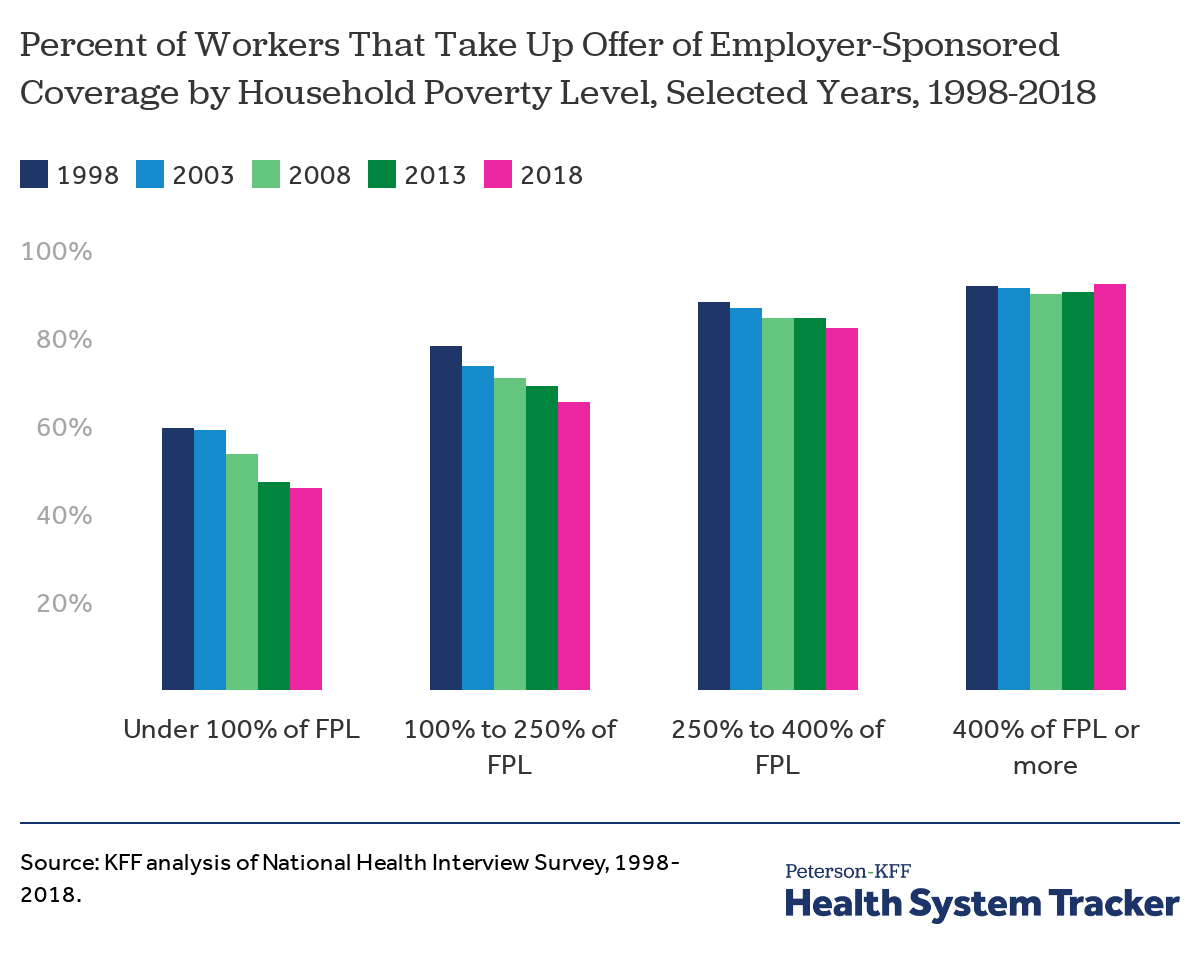

Long Term Trends In Employer Based Coverage Peterson Kff Health System Tracker

Does A Company Have To Offer Health Insurance To Employees In California

Long Term Trends In Employer Based Coverage Peterson Kff Health System Tracker

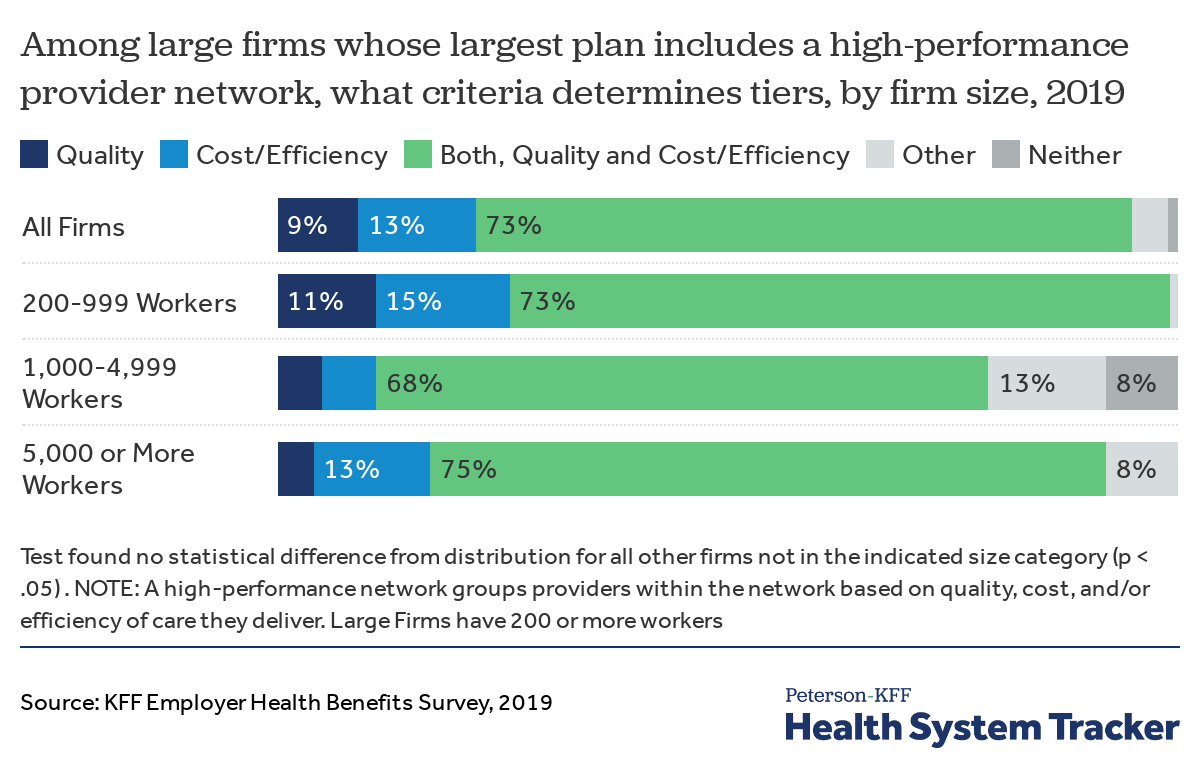

Employer Strategies To Reduce Health Costs And Improve Quality Through Network Configuration Peterson Kff Health System Tracker

Best Loss Of Health Insurance Coverage Letter From Employer Template Doc Sample In 2021 Letter Sample Letter Example Letter Writing Template

Can An Employer Cancel Your Health Insurance While You Are Out On A Disability

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Anybody Self Employed Got Medical Insurance Successfully In Usa Insurance Quotes Health Insurance Quote Cheap Car Insurance Quotes

Small Business Health Insurance Requirements 2021 Ehealth

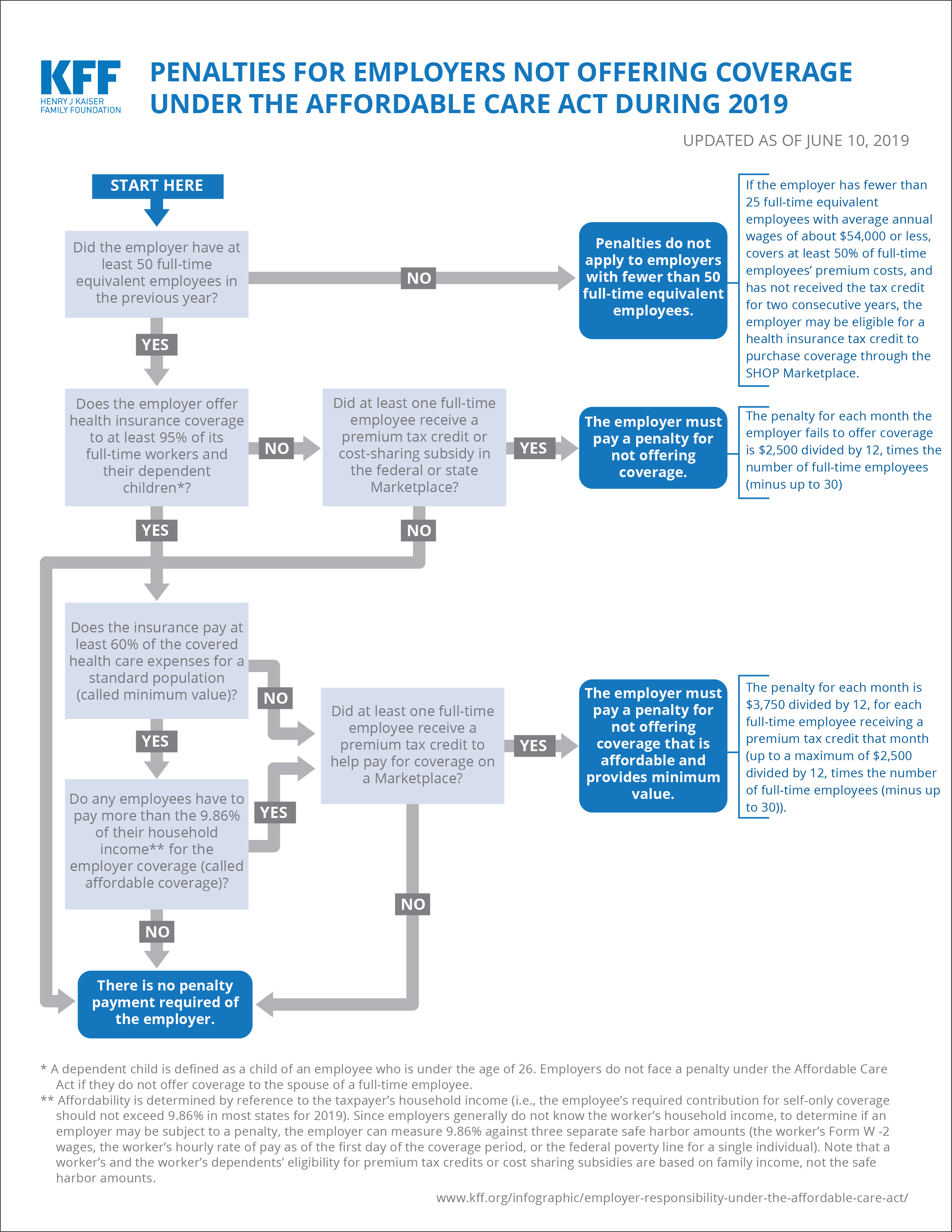

Employer Responsibility Under The Affordable Care Act Kff

How Has Covid 19 Affected Health Insurance Offered By Small Businesses In The U S Early Evidence From A Survey Catalyst Non Issue Content

![]()

Employer Strategies To Reduce Health Costs And Improve Quality Through Network Configuration Peterson Kff Health System Tracker

Posting Komentar untuk "Can I Decline My Employer's Health Insurance"